download the brief

Key Findings

The aging of the U.S. population is an ongoing trend. The U.S. Census Bureau projects that by 2050 one in every five Americans will be over 65,1 and that by 2060 the over-65 population will have doubled in absolute size and the over-85 population will have tripled.2 Life expectancy of a 65-year-old in 2014 compared to 1980 was 3.9 years longer for a man and 4.3 years longer for a woman.3

Of course, not all of these extra years are experienced in full health. The prevalence of chronic disease in this age group is high—approximately 50 percent of those over 65 suffer from hypertension and 20 percent of 65- to 84-year-olds have diabetes, for example—and many elderly suffer from functional limitations at some point. While only 5.2 percent of 65- to 74-year-olds have difficulty dressing and bathing themselves, almost one-third of those over 85 do.4

Research has shown that a variety of health outcomes and behaviors, ranging from mortality5 to smoking6 to time spent receiving medical care,7 are sensitive to changes in economic growth, and that the effects may vary by age.8

This brief looks at the relationship between macroeconomic conditions, as measured by the national unemployment rate, and utilization of long-term care, as measured by respondents’ reports in the Health and Retirement Study (HRS) of what type of care they received in the past month to help with daily activities.

Utilization of Long-Term Care

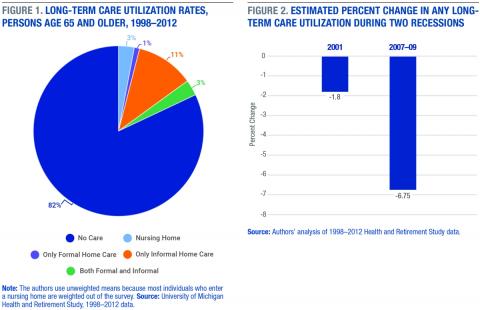

Long-term care for older adults can take the form of nursing home care, formal (paid) home care, or informal (unpaid) home care. Almost 1 in 5 individuals over the age of 65 gets some type of help with activities of daily living (ADLs) such as bathing, dressing, and self-feeding, or with instrumental activities of daily living (IADLs) such as preparing hot meals and taking medications9 . According to the HRS data, from the years 1988 to 2012, 86 percent of respondents over age 65 use some form of long-term care, and the predominant form—used by 11 percent of respondents—is informal care provided in the home, usually by a family member (Figure 1). Approximately 3 percent of survey respondents were in a nursing home10, just over 1 percent exclusively received care in the home from a paid provider, and 3 percent used some mix of formal and informal home care.

Overall Utilization Declines

Based on an analysis of long-term-care utilization data in the HRS from 1998 to 2012, we estimate that a 1 point increase in the unemployment rate is associated with a 1.5 percent drop in utilization of any form of long-term care.11 Figure 2 shows the total effects implied by this estimate for the two most recent recessions in the United States. During the 2007–2009 Great Recession, when the unemployment rate rose from 5.0 percent (December 2007) to 9.5 percent (June 2009), utilization likely dropped 6.75 percent. During the much smaller downturn of 2001, when the unemployment rate rose from 4.3 percent (March 2001) to 5.5 percent (November 2001), utilization is estimated to have dropped 1.8 percent.

Declines Driven by Drop in Informal Home Care

The type of long-term care used can vary dramatically by a person’s health care needs and personal circumstances. For example, the need for nursing home care may be driven by conditions such as Alzheimer’s disease that require constant care and supervision, whereas informal home care is strongly affected by proximity to one’s relatives and each relative’s labor status. Our estimates show that all of the change in overall long-term care utilization described above was the result of a decrease in the most common type of care, informal home care. We estimate that for every percentage point increase in the national unemployment rate, utilization of informal home care fell 14.6 percent.

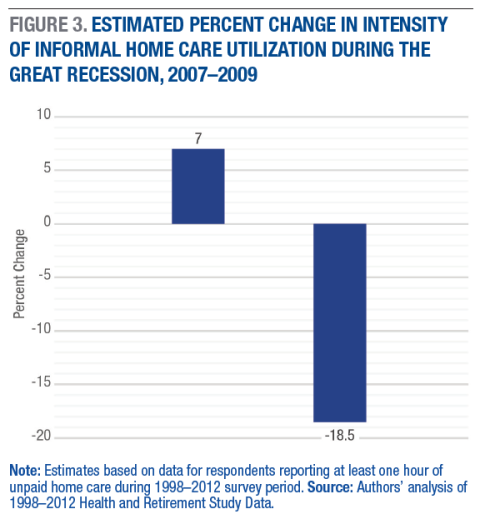

Just as important as the utilization of care is the kind of and intensity of care among those who report receiving any care. Figure 3 shows the effects of the 2007–2009 Great Recession on the two primary components of the intensity of unpaid home care utilization: the number of unpaid caregivers, and the number of hours of care received from these caregivers.

As Figure 3 shows, the estimated effect of the 2007–2009 Great Recession is an 18.5 percent decline in total hours of unpaid home care reported. At the same time, there was a significant 7 percent increase in the number of unpaid caregivers that care users reported. There are several reasons why average hours of care might fall while the number of caregivers making up those hours rose. The most likely is that higher unemployment increases the availability of adult children and other relatives to provide occasional care.

Why Does Utilization Decline in a Recession?

Many factors affect demand for and access to different forms of long-term care, and changes in the business cycle have the potential to affect several of them. We can think of the factors that affect utilization as belonging to one of two broad groups: access factors and needs factors. Access factors determine what an individual’s choice set looks like if care is needed.

One key access issue may be whether or not unpaid care in the home is available, and for most elderly persons this depends on having a healthy spouse or adult child who is able to provide care. During recessions, the elderly are more likely to report living with an adult child and less likely to report that their children are employed full time. Both of these factors would seem to encourage more informal caregiving, and previous studies have shown that children who work less provide more care.12 However, though the number of informal caregivers rose, utilization of informal care actually fell during the recession.

For formal care, affordability is likely to be a key to access.13 The majority of individuals who need long-term care are likely to be retired, and their asset holdings and income, except for pensions and Social Security, tend to vary with economic conditions. A similar model to the one used to estimate utilization changes shows that, during the Great Recession, there was no significant change in the incomes of elderly households in the HRS sample, but the average loss in wealth (likely driven by decreases in the value of real estate holdings and investments) associated with the unemployment increase was $12,163. However, we do not find any significant changes in formal care associated with the Great Recession.

Poorer but Healthier?

It seems reasonable that changing macroeconomic conditions can generate wealth and income fluctuations that affect the affordability of formal long-term care, or can influence the number of family members available to provide informal care. What may be less obvious is that recessions can also affect health, disability, and the need for care. Studies in health economics have shown that many aggregate measures of health improve during recessions, and that a health improvement is specifically felt by the elderly.14 The explanations for this phenomenon include better health behaviors (for example, smoking less and exercising more) among individuals who are working less, as well as fewer auto accidents. Particularly relevant to the elderly may be better staffing in long-term care settings. Research suggests that both employment rates and the length of time nursing home workers stay in jobs increases when unemployment is high.15

If better health indeed follows from recession, this outcome is a likely explanation for both the decrease in any utilization of care and the decrease in total hours of informal home care. Using the same method described above, we estimate that there was a 6.52 percent decrease associated with the Great Recession in the fraction of the elderly in fair or poor health. There was also a significant decrease in the number of limitations in ADLs for women as the unemployment rate increased.

Conclusion

The economic contraction of 2007–2009 impacted almost all Americans in some way. The drop in real gross domestic product was the largest in the United States since World War II. The average net worth of U.S. households fell by over 20 percent, and the unemployment rate more than doubled before the labor market started to recover.16

The elderly, the nation’s largest-growing population segment, were affected in a number of important ways, including their need for and utilization of long-term care. Surprisingly, despite a large reduction in wealth in elderly households caused by the recession, we do not find a significant change in utilization in either paid home care provided by non-relatives or nursing home care.17 However, based on the results of our analysis, the increase in the national unemployment rate associated with the Great Recession resulted in a significant decrease in the utilization of informal (unpaid) care provided in home by family members.

The cause of a reduction in informal home care is not immediately obvious. One contributing factor could be an unexpectedly positive health effect of the recession for the elderly: consistent with much of the existing literature on economic conditions and health, we find that two important measures of health for the elderly—self-reported health status and number of limitations with ADLs—improve significantly when unemployment rates are higher. All else equal, better health, and especially fewer limitations, should reduce demand for long-term care. One other possible explanation for less utilization of informal care, and one that we cannot test in our data, is based on the fact that children who provide care to their parents may do so in exchange for occasional cash transfers or promises of a bequest; this care provision might have fallen because elderly parents had less wealth during economic downturns.18

That recessions are associated with better health for certain individuals, especially the elderly, is one of the more unexpected findings to come from research on the relationship between the economy and health.19 The results presented here are consistent with those findings.

Data and Methods

This brief uses data from the 1998 through 2012 waves of the Health and Retirement Study (HRS) conducted by the University of Michigan. Data from the original HRS cohort (born between 1931 and 1941), the AHEAD cohort (born before 1924), and the Children of the Depression Age Cohort (born between 1924 and 1931) are pooled to make up the analysis sample.

Estimates of long-term care utilization and wealth effects of the Great Recession come from the multivariate regressions that control for the following individual characteristics: age; marital status; education level; number of reported problems with ADLs; number of reported problems with IADLS; and indicators for diabetes, cancer, heart condition, stroke, memory disease, arthritis, and incontinence. Models for health effects include only controls for age, marital status, and education levels. All models include individual fixed effects.20 Differences presented in the text are statistically significant unless otherwise indicated.

We measure changes in macroeconomic conditions from month to month using the national unemployment rate. During the 2007–2009 Great Recession the unemployment rate rose by 4.5 percentage points, and during the 2001 recession it rose by 1.5 percentage points. This is the value we use in estimating the effect of changes during the Great Recession.

Box 1: Definitions

Activities of daily living (ADLs) are the set of everyday activities involved in self-care. They include moving from one place to another (e.g., getting out of a chair without assistance), bathing and showering, dressing, feeding, personal hygiene (e.g. combing hair), and toilet hygiene.

Formal home care refers to care provided in the recipient’s home for regular pay. This care is usually delivered by a non-relative caregiver, but the category also captures friends and relatives who are paid for care.

Health is measured at the individual level using several indicators. Subjective health status is measured by the respondent on a four-point scale: excellent, good, fair, and poor.

Informal home care refers to care provided in the recipient’s home without a regular pay agreement. It is usually provided by a relative such as a spouse or adult child.

Instrumental activities of daily living (IADLs) are skills that are not as basic as ADLs but that allow an individual to live independently in the community. They include doing housework, preparing meals, shopping, using the telephone, managing money, and taking medications as directed.

Nursing home care refers to care in a residential facility that provides the following services: room, meals, assistance with personal care, dispensing of medication, and 24-hour nursing assistance.

Wealth is measured at the household level and includes the values of primary residence, secondary residence, additional real estate, business assets, all vehicles, individual retirement accounts, stocks, mutual funds, savings accounts, bonds, and CDs.

All are net values.

Endnotes

1. U.S. Census Bureau, “65+ in the United States,” P23-212, 2014.

2. U.S. Census Bureau, “2012 National Population Projections,” 2012, http://www.census.gov/population/projections/data/national/2012.htm.

3. U.S. Department of Health and Human Services, Centers for Disease Control and Prevention, “Health, United States, 2016,” 2017, https://www.cdc.gov/nchs/data/hus/hus16.pdf#015.

4. U.S. Census Bureau, 2014.

5. Christopher Ruhm, “Are Recessions Good for Your Health?” Quarterly Journal of Economics (May 2000): 617–50; Ann Stevens, Douglas L. Miller, Marianne E. Page, and Mateusz Filipski, “The Best of Times, The Worst of Times: Understanding Pro-Cyclical Mortality,” American Economic Journal: Economic Policy 7, no. 4 (2015): 279–311; Yaa Akosa Antwi and John R. Bowblis, “The Impact of Nurse Turnover on Quality of Care and Mortality: Evidence From the Great Recession,” Working Paper 16-249 (Kalamazoo, MI: W.E. Upjohn Institute, 2016).

6. Ruhm, 2000.

7. Mark Aguiar, Erik Hurst, and Loukas Karabarbounis, “Time Use During the Great Recession,” American Economic Review 103, no. 5 (2013): 1664–96.

8. Courtney C. Coile, Phillip B. Levine, and Robin McKnight, “Recessions, Older Workers, and Longevity: How Long Are Recessions Good for Your Health?”American Economic Journal: Economic Policy 6, no. 3 (2014): 92–119.

9. H. Stephen Kaye, Charlene Harrington, and Mitchell P. LaPlante, “Long Term Care: Who Gets It, Who Provides It, Who Pays, and How Much?” Health Affairs 29, no. 1 (2010): 11–21. The full set of ADLs is walking, dressing, bathing, eating, getting in and out of bed, using the toilet, getting in and out of chairs, going outside, continence, and taking care of personal needs. The full set of IADLS is preparing hot meals, shopping for groceries, making telephone calls, taking medications, managing money, using a map, driving, using a microwave, using a calculator, and using a computer.

10. Note that we are likely under-estimating utilization of nursing home care because the HRS data only record it if a respondent is in a nursing home at the time of the survey. The data do not pick up stays in nursing homes in between the biennial surveys, and most survey respondents who are in nursing homes for two years or more drop out of the survey.

11. Bureau of Labor Statistics, “The Recession of 2007–2009,” BLS Spotlight on Statistics, February 2012. We estimate this effect by multiplying the percent change per one-unit increase in the unemployment rate implied by our model coefficients by the peak-to-trough change in national unemployment for the start and end months of each recession, using dates from the National Bureau of Economic Research’s Business Cycle Dating Committee (http://www.nber.org/cycles.html) matched to monthly unemployment rates from the Bureau of Labor Statistics (https://data.bls.gov). The start/end dates of the 2001 recession are March 2001 and November 2001, and the start/end dates for the Great Recession are December 2007 and June 2009. Because the primary variable used in business cycle dating is gross domestic product (GDP), the full change in unemployment rates over the recessionary period is often slightly larger than our cycle-date-based estimates.

12. See, for example, Axl Heitmueller, “The Chicken or the Egg? Endogeneity in Labor Market Participation of Informal Carers in England,” Journal of Health Economics 26 (2007): 536–59; and Ursula Henz, “Informal Caregiving and Working Age: Effects of Job Characteristics and Family Configuration,” Journal of Marriage and the Family 68 (2006): 411–29.

13. Peter Kemper, in “The Use of Formal and Informal Care by Disabled Elderly,” Health Services Research 27 (1992): 421–51, finds a positive relationship between income and formal care overall; Gopi Shah Goda et al., in “Income and Utilization of Long-Term Care Services: Evidence From the Social Security Benefit Notch,” Journal of Health Economics 30 (2011): 719–29, find that nursing home care decreases and formal home care increases when income is higher; however, their results are for a permanent shock to income, as opposed to the temporary one caused by macroeconomic conditions.

14. Ruhm, 2000; Stevens et al., 2015; Antwi and Bowblis, 2016.

15. See Antwi and Bowblis, 2016; Stevens et al., 2015; Reagan A. Baughman, “Employment in Long-Term Care: The Role of Macroeconomic Conditions,” Working Paper, University of New Hampshire, 2017.

16. Robert Rich, “The Great Recession 2007–2009,” Federal Reserve History, 2013, www.federalreservehistory.org/Events/DetailView/58.

17. An important caveat is that we may not be able to detect significant changes in nursing home utilization because such a low fraction of individuals in our HRS sample—an average of 3 percent—are in nursing homes in a given year.

18. Edward C. Norton et al., in “Informal Care and Inter-Vivos Transfers: Results From the National Longitudinal Survey of Mature Women,” B.E. Journal of Economic Analysis and Policy 14 (2014): 377–400, find that children who provide informal care to their parents are 8.6 percentage points more likely to receive a financial transfer from their parents; Edward C. Norton and Courtney H. Van Houtven, in “Inter-Vivos Transfers and Exchange,” Southern Economic Journal 73 (2006): 157–72, similarly find that children who provide care are three times more likely to receive such transfers compared to their siblings who do not provide care.

19. Ruhm, 2000; Stevens et al., 2015; Antwi and Bowblis, 2016.

20. For more detail on the empirical method as well as additional results from a model based on county-level unemployment see: Jon Hurdelbrink and Reagan Baughman, “The Impact of Macroeconomic Conditions on Utilization of Long-Term Care,” Working Paper, University of New Hampshire, 2017.

Acknowledgements

The authors thank Kristin Smith, Michele Dillon, and Michael Ettlinger for helpful comments.