Ever wonder where federal tax dollars go? Curious how much federal government spending goes toward the military, health care, or education? Want to understand what all those government programs you hear about do? If so, FedGovSpend™ Explorer is the tool for you! Using data from the Office of Management and Budget (OMB) and Congressional Budget Office (CBO), FedGovSpend™ shows, in easy-to-follow pie charts, the budget outlays of the United States federal government. Easy to understand explanations, and year-to-year comparisons, are available at a touch of the screen or a click of the mouse.

FedGovSpend™ Explorer is available on the web at fedgovspendexplorer.org and as a mobile app, downloadable from the Apple and Google Play stores.

When you first open FedGovSpend, you’ll see the federal budget divided into spending categories: Health, National Defense, Transportation, and the rest. If you want to dig deeper into a specific area within the federal spending pie chart, you can. Select “Health,” for example, and see the national healthcare spending pie chart, broken down more narrowly by health care services, health research, occupational safety, and more. Choose one of those categories and get even more detail. At each layer, descriptions are available for what those spending dollars accomplish. You can explore what the government spends its money on; how much goes to Medicaid, government retiree health coverage, the National Institutes of Health, and the other federal programs that comprise the government’s health spending. If you are more interested in looking at federal outlays organized by agency (Department of Interior, Department of Commerce, etc.) or spending type (mandatory or discretionary) than by their purpose, those optional views can be selected in the side menu on the app or at the top of the web explorer. The answers are here in as much or as little detail as you want.

Suggestions & Feedback

Have an idea to make FedGovSpend™ better or any other feedback? Send an email to FedGov.Spend@unh.edu.

FedGovSpend Explorer Version 2.0 Preview Video

What’s Under the Hood

The brand-new web version of FedGovSpend includes all the features in Version 2.0 of the app, plus some bonus features! Check them out now!

Years, Data Sources, and Updates

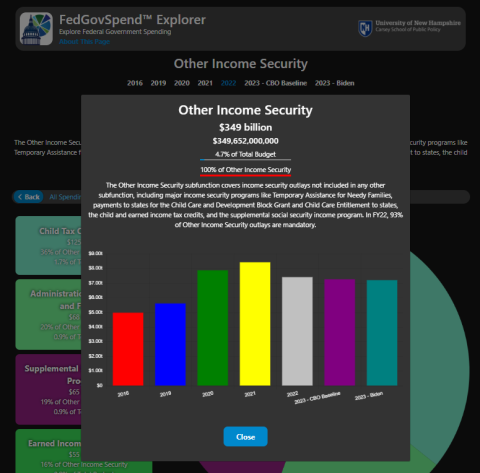

The data currently available are outlays for Fiscal Years (FY) 2016, 2019, 2020, and 2021 as reported by the Office of Management and Budget (OMB) and current law projected outlays for FY 2022 from the Congressional Budget Office (CBO) as of May 2022. FY 2023 ‘CBO Baseline’ data come from CBO current law projections as of May 2022 and FY 2023 ‘Biden’ data come from President Biden’s FY 2023 budget proposal, as reported by OMB. The federal fiscal year runs from October through September. For example, FY 2021 runs from October 1, 2020 to September 30, 2021.

As new data become available, FedGovSpend™ Explorer is updated to reflect the most up to date projections and actual spending data in past and current fiscal years. Prior year outlay data typically become available when the president’s budget proposal is released early in the calendar year, except in years following presidential elections, when the release is typically delayed by several months.

How Spending Is Measured: Outlays Versus Budget Authority

There are multiple ways to measure federal spending. FedGovSpend™ shows “outlays,” which are a measure of how much money the federal government spends in a given fiscal year. This differs from “budget authority,” which is also used by some analysts. Budget authority is how much money has been authorized in a fiscal year—even if those dollars are not spent until later years.

Three Ways to View Government Spending

In FedGovSpend™ Explorer federal outlays can be seen organized by the purpose which it serves, the spending type (mandatory spending or discretionary spending) or by the agency which controls the outlays. To toggle between views, tap the selector in the upper right-hand corner of the screen.

In the dropdowns below are descriptions of each of these three selectable views:

In “Function” view, FedGovSpend™ allows users to visualize the breakdown of federal spending organized by the purpose which it serves, relying on the federal government’s official budget functional classifications. Outlays are organized in a hierarchy, from very broad categories of spending to more specific. The budget terms used for these levels of aggregation are “function,” “subfunction,” “bureau,” and “account.” There are 17 "national needs" budget function categories at the top level, which are then divided into subfunction and further divided into bureau and then account level categories of spending. For example, the Health function is comprised of three subfunctional categories: Health Care Services, Health Research and Training, and Consumer and Occupational Health and Safety. These subfunctions are then split into “bureau” level categories such as Centers for Medicare and Medicaid Services and the Centers for Disease Control and Prevention (CDC). Although the government uses the word “bureau” in its data sets, these categories do not in every case indicate a specific office or unit in the government and the term is not generally used in FedGovSpend™. There is a final “account” level of specificity below the bureau level which describes specific line-item accounting of spending. FedGovSpend™ does not show account level spending but instead uses information from these account-level data to generate the bureau-level descriptions. More details about the federal government’s system of budget classification and its functional and subfunctional categories can be found in the US Government Accountability Office’s publication “A Glossary of Terms Used in the Federal Budget Process”.

Some bureau-level spending appears in multiple subfunctions and functions. For example, The Administration for Children and Families has outlays classified under both the “Income Security” function, in the “Other Income Security” subfunction, and the “Education, Training, Employment, and Social Services” function, in the “Social Services” subfunction. Where appropriate, bureau descriptions denote where spending occurs across multiple functional or subfunctional categories to give a more complete picture of how that agency or program fits into overall federal spending.

FedGovSpend™ generally follows the official government organization and all data are sourced from official sources; however, some organization has been edited for clarity and ease of understanding.

In “Spending Type” view, the app allows users to view spending across budget function classifications as in Function view, but separately for the mandatory and discretionary parts of the federal budget. Mandatory spending refers to spending that is permanently authorized (such as Social Security), while discretionary spending must be approved each year by Congress and the President through the annual federal budget process and related appropriations bills.

FedGovSpend™ Explorer also allows users to view outlays by agency, with categories for the major federal departments as well as a catch-all category that contains smaller independent federal agencies that do not fit neatly elsewhere.

FedGovSpend Explorer Version 2.0 Preview Video

A Note on Tax Expenditures

Some government spending is administered through the tax code. The simplest way to think about this is that instead of the government sending a check, as it does for Social Security and other benefit spending, a “tax expenditure” reduces the beneficiary’s federal tax liability. Whether one gets a check for $1,000 from the government or pays $1,000 less in taxes amounts to the same thing financially. There are lots of examples of these tax expenditures across government spending, including the Earned Income Credit, the Child Credit, Health Care Subsidies, the Mortgage Interest Deduction, Tax Exempt Interest, and numerous business tax breaks. How these are handled in government accounting is a little tricky. To the extent that tax expenditures reduce the amount of tax paid, they show up in the revenue side of the budget as lower tax collections—and thus do not appear in FedGovSpend™ Explorer. For some tax credits, however, if the credit exceeds the tax that would otherwise be owed, the government does send a check (or transfers funds) program for the amount by which the credit exceeds the pre-credit tax liability. The amounts sent in these “refundable tax credits” do appear in federal budget outlays as spending and are therefore included in FedGovSpend™ Explorer.

One question you might have is “if tax expenditures are just government spending in another form why aren’t they all included in FedGovSpend™ Explorer?” Although the federal government does produce a “tax expenditure budget”, the challenge with integrating it with the rest of the spending budget is that the complexity of the tax code creates many interactions between different tax expenditures. In the regular spending side of the budget if the government spends less or more money on a program the impact is usually straightforward. Decreasing or increasing the size of some tax expenditures, however, can cause ripple effects on the rest of the tax return, which can increase or decrease the spending on other tax expenditures. Without being able to account for those interactions, mixing in the entire set of tax expenditures with the rest of the budget would be misleading.

Credit Subsidy Accounting

Government credit subsidy programs can be either subject to “credit reform” accounting, in which case the subsidy cost is calculated and is included in spending, or accounted for on the basis of cash flow. Descriptions of credit programs in FedGovSpend™ Explorer specify which form of accounting is used.

The FedGovSpend Explorer mobile app was launched in June 2021. Development of the app began in 2020.

The app was developed by Michael Ettlinger, Director of the Carsey School, and Jordan Hensley, a policy analyst at Carsey. The app was built and designed by Dave Coffin of nstudio.

There are a variety of online tools that allow people to track U.S. government spending, however few – if any – are as easy to use as the FedGovSpend Explorer app. It uses simple, easy-to-understand pie charts, as well as bar charts for year-over-year comparison (new to Version 2.0). Importantly, it also goes beyond charts and simple names of units of government to offer brief, understandable, descriptions of what the money spent in each area accomplishes. The app pulls data from more complicated official data bases, such as the Office of Management and Budget and the Congressional Budget Office’s Budget and Economic Data website, converting the information into a more digestible, understandable format.

The FedGovSpend Explorer app displays spending outlays, which are amounts spent during a given fiscal year. Outlays differ from budget authority, which is used by some analysts and measures the amount of money authorized for a given fiscal year, even if those amounts aren’t spent until future fiscal years.

In 2021, the federal had spending outlays of $8.66 trillion. Within the FedGovSpend Explorer app, you can see how this amount breaks down by Function (i.e., the purpose for which it’s been allocated – Health, Defense, Social Security, etc.), by Spending Type (i.e., was it Mandatory funding that wasn’t approved congressionally, Discretionary funding approved by Congress and the President, or Interest Payments), and by Agency (i.e., spending by each federal agency). You can toggle between all three breakdowns on the Menu screen (use the Menu button in the upper right-hand corner of the app to access).

One of the Carsey School’s mostly widely read research reports – the COVID-19 Economic Crisis: By State report – examined employment and jobs data for each U.S. state and by industry type. The report was launched in April 2020; regular updates to the research ended in October 2021 (however, the data will be updated sporadically moving forward). You can find the entire report online.

Other recent Carsey research examined inequities found during the job recovery of the COVID-19 pandemic, drops in employment income during the pandemic, and the impact of tax relief efforts like the Earned Income Tax Credit.

Look in the app to find out! It depends on how you view the data and for which year you look at the data. In 2019, the federal government spent 20 percent of its budget (about $1.14 trillion) on Medicare. That same year, Social Security made up the second-largest spending function – 19 percent or $1.08 trillion. If you were to organize the data by Agency for 2019, you’d see 30 percent (or $1.7 trillion) of the budget went toward the Department of Health and Human Services (DHHS) – the agency responsible for administrating Medicare.

In 2021, the federal government spent 20 percent of its budget ($1.72 trillion) on income security, which includes unemployment and stimulus payments for COVID-19 relief. Medicare spending was 15 percent of the budget (or $1.3 trillion) that year. Agency view shows 26 percent of the total budget in 2021 ($2.23 trillion) went to the DHHS, while 15 percent of the budget (or $1.27 trillion) went to the Department of Treasury, which was responsible for dispersing COVID-19 stimulus relief.

In fiscal year 2023, the government has amassed $318.58 billion in revenue. Revenue is collected throuhg income taxes, payroll taxes, corporate taxes, excise taxes, national parks, and customs.

In fiscal year 2023, the government has spent $406.37 billion. Federal government spending goes towards programs and services aimed at supporting Americans. Other spending includes treasury notes and bonds. View the Explorer and find out!

Check out the Explorer to find out! Federal government spending goes towards programs and services aimed at supporting Americans. The top spending categories are health programs, social security, and national defense totaling to over half of all federal spending.

Discretionary spending is decided by Congress, requiring an annual vote. Mandatory spending cannot be changed as it is determined by preset laws and regulations. You can view federal spending by type in the Explorer!

The Center on Budget Policy and Priorities (CBPP) provides nonpartisan research and analysis of the federal budget, with an emphasis on how budget policy impacts low-income Americans. Some helpful CBPP introductory primers to the federal budget process include:

USAspending.gov’s Spending Explorer is a web-based tool that allows users to explore federal spending by linking federal agency financial data together in one database. It was created as part of 2006’s Federal Funding Accountability and Transparency Act, and expanded in 2014 after the passage of the Digital Accountability and Transparency Act. USAspending.gov’s data comes directly from federal agency financial systems, other government systems, and entities that receive government awards. These data are very similar to the data reported in the FedGovSpend™ Explorer app across functional, subfunctional, and bureau level spending categories, although USAspending.gov’s data show budget obligation rather than outlays. Budget obligation differs from outlays in that obligation refers to money the government has promised to spend either immediately or in the future, while outlays are actual spending amounts. In addition, USAspending does not have descriptions of the spending.