download the brief

Key Findings

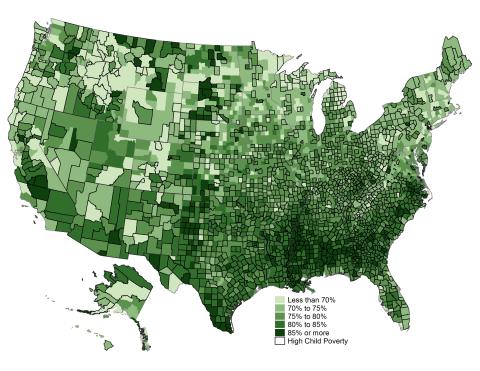

Recent proposals in the House and Senate (for example, the Grow American Incomes Now Act) focus on amplifying the Earned Income Tax Credit (EITC)—a refundable tax credit for low-income workers—to compensate for growing wage inequity. We find that the share of EITC filers who are families with children is especially high in the poorest counties (those counties outlined in black on Map 1), including many places throughout the South. Many of these counties are nonmetropolitan counties (see Map 2), suggesting that the EITC can provide safety net support in places where other social services may be less available. While an EITC expansion could be costly, existing research shows that its effects on poverty reduction, employment, and both children’s health and achievement are considerable, and therefore, worth considering in the scheme of ongoing broad tax revisions.