download the brief

Key Findings

In this brief, we use interview and focus group data to describe some of the ways that restricted rural housing stock affects working families in two rural New England counties, and explore solutions proposed by rural residents and experts to make housing affordable (see Box 1 on page 2). Rural amenities and scenery make residence in certain New England regions desirable for second-home owners, vacationers, and retirees. However, the use of housing for these purposes, combined with efforts to conserve acreage and preserve scenery, serves to diminish the supply of housing, making it unaffordable for many low- and moderate-income residents. Moreover, the housing that is available varies in quality, and regional nonprofit and federal housing assistance programs lack the capacity to meet all residents’ needs.

‘We live in a region where second-home ownership is very desirable’: Implications for Locals

Affordable housing is a challenge in many rural places. Forty-one percent of rural renters are cost-burdened,1 spending more than 30 percent of their income on housing, and beyond cost, issues of housing availability and quality persist. Though vacant housing is plentiful in rural areas—in New England, 28.9 percent of rural housing units are vacant, compared with 10.3 percent in both its cities and suburbs—it is not necessarily “available.” Three-quarters (74.6 percent) of New England’s rural vacant housing units are designated for seasonal, recreational, or occasional use,2 while just 3.5 percent are available for rent (the share in New England cities and suburbs is 22.9 percent and 13.3 percent, respectively).3 Further, even available properties might be in disrepair or unaffordable for local workers.

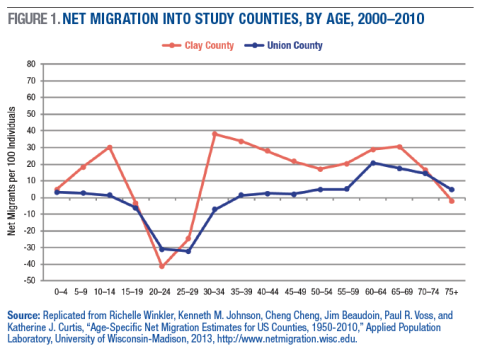

For some New England counties, including the two studied here—named Clay and Union for purposes of this report4—the in-migration of retirees is an important influence on housing stock for existing residents. One retiree who had moved to Clay County explained, “I loved [where I used to live], and if I could have afforded it, I would have stayed there and bought property, but I couldn’t. Property values are considerably less expensive here.” Indeed, like many New England counties, Clay and Union have significant inflows of retirement-aged individuals (see Figure 1). “The only people that can afford it—or a lot of it—are people that retired from away that want to build a home on the shore or something like that.”

Clay County is considered a recreation county,5 defined as one where people from other regions come for day tourism and seasonal recreation opportunities. One Clay County social service provider explained, “We live in a region where second-home ownership is very desirable and the people who are interested in doing that make five times the income that the workers here make….We appreciate the second-home market—nobody’s saying it’s a bad thing—but at the same time…that means you have not very many options for the people who are working here.”

Some Clay social service providers highlighted the link between rental stock and second-home ownership: “There’s a really high percentage of second homes here.…[Property developers ask] ‘how can you make the most money?’ It’s not renting locally. It’s through the vacation rental.”

In Union County, one provider linked rising rental prices to property values: “Part of it’s…because [in] coastal communities, the land is very valuable. So as [a] result, the tax rate keeps going up and up and up.” And as land values continue to rise, Union County natives may be increasingly displaced by high tax costs: “There’s a lot of people who are land-rich and cash-poor, [and] have to sell their frontage.” Another person explained, “These old people, they can’t afford to live on the water where they used to. These fishermen all lived on the water…it was the way it was. They can’t afford taxes on the water anymore….[Now, they] dry up and blow away.”

‘We aren’t zoned for affordable housing’

In addition to challenges with existing housing stock, rural property developers face issues of zoning restrictions and costly infrastructure development. Many towns designate minimum lot sizes in order to preserve open space and prevent dense groupings of residential structures that would alter the area’s scenery. This issue is especially important in Clay County, where retirement and recreation industries are critical to the region’s economy. One Clay social service provider explained that these regulations mean that the region “certainly does not lend itself to cluster, or more affordable, housing configurations.” Another provider concurred, explaining, “The reason we don’t have more affordable housing is that our regulatory environment doesn’t allow it. We are zoned for upscale primary and second homes.”

When the construction industry faltered in the wake of the Great Recession, one social service agency tried to discuss affordable housing development with construction experts. A Clay County provider explained, “When we talked to them during this time and we said, ‘You know, the second-home market is down, why haven’t you tried to develop more affordable housing for people who…would like to live here…?’ And they said, ‘It’s [a] density [issue]. We aren’t allowed. You have to buy too much land for one unit. If you buy a parcel of land and carve it up into two-acre lots, you’ve got a road system [to install] and you’ve got land costs before you even put a stick in the ground. It’s just too expensive. We aren’t zoned for affordable housing.’”

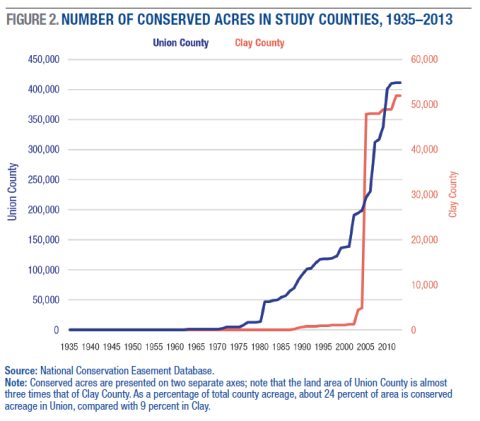

While residents of Clay County were more likely than residents of Union County to cite zoning as an important issue, quantitative data reveal that this might be an increasingly pertinent issue in both communities. Despite rural areas’ reputation for endless space, conservation efforts beginning in the 1980s in both counties may limit the number of acres available for development. For instance, between 1990 and 2010 the number of acres protected by conservation efforts—and thus unavailable for housing development—increased three-fold in Clay County and seventy-fold in Union County, as shown in Figure 2.

‘And the housing stock is despicable’

In addition to limited housing stock, rural places with high rates of second-home ownership or retiree in-migration may face a bifurcation in housing quality. We found evidence of this pattern in both Union and Clay. One Union County service provider described “the incredible contrast between housing along a strip. There [are] a lot of big, beautiful, incredible houses coming up here—just amazing. And then next door is this shack.” Indeed, in Union County, we observed towns where run-down, small homes abutted large, contemporary homes with coastal views. In Clay County, “You have a housing stock of really high-end homes and you have a housing stock of really old, dilapidated, inefficient homes.” A Clay service provider noted that “there’s plenty of housing here, though I don’t think it’s affordable for people who are making minimum wage, or just over minimum wage, at retail places or seasonal jobs.” A different Clay provider suggested, “The rents are fairly affordable but the homes that the people are renting, or the apartments, they’re inefficient, you know? You could feel the wind going through the living room.” These kinds of inefficiencies have particular implications in the New England climate. As a Union County provider explained, “We have an older housing stock here and we have extreme weather as well and we tend to rely on oil as our primary source of heat, which just sets us up for ridiculous heating costs in a lot of homes.” However, providers acknowledge that “there just aren’t enough resources to deal with the long-term cost of maintaining the buildings here.”

‘You’re looking at one- to two-year waiting lists’

With limited housing stock, low-income rural residents turn to a host of formal and informal supports to help them meet their housing needs. Subsidized housing options—through the federal government’s housing choice voucher program (“Section 8”) or similar—can provide valuable assistance to residents. One low-income mother described her subsidized apartment as “really helpful. It’s nice—they just built the building two years ago, so it’s a brand-new apartment building…It’s affordable…[and] yeah, it works out well.”

However, mirroring the national landscape, the capacity of subsidized housing arrangements often cannot meet need in many communities. The U.S. Department of Housing and Urban Development (HUD) notes that “since the demand for housing assistance often exceeds the limited resources available to HUD and the local housing agencies, long waiting periods are common.”6 In Clay County, “You’re looking at one- to two-year waiting lists—sometimes they’re longer for our low-income housing or Section 8 housing here.” Even when applicants on the waiting list are served, they can face issues beyond program capacity. “I know that there are a couple of families…[who] had the voucher, when they went to use it…[they] talked to a couple of landlords who said that what Section 8 can pay is not enough…You know, the Section 8 voucher in that case was worth like $550 and [the landlord] said, ‘You know, I can get $700 for that apartment, and I want to help, but it’s just not enough.’ So, there are a lot of challenges getting the voucher, having the voucher, then finding a place to go with it.”

‘I could possibly be homeless’

When people cannot access the formal safety net, challenges abound. For a Clay County woman who learned that her landlord intended to sell the apartment building where she lived, pulling together a security deposit for a new apartment was a barrier. “People like us, we don’t have two, three thousand dollars right up front to move into some other place. It’s hard.” She continued, “I mean who would’ve thought at 45 I could possibly be homeless? I’ve held the same job for all this time. I’m not an over-spender, I’m very thrifty, and you know it’s a reality.…” In Union County, agencies tried to provide services where they could, but resources are limited, both in agencies and in the families they serve. “We’ll say to the folks, ‘Do you have a backup plan if we can’t help you…?’ And it turns out the backup plan is already there. They’re [already] all living together.”

Alternate housing arrangements come into play when families can’t afford traditional housing and can’t access the formal safety net. Union County providers see “people living in campers,” and in Clay County, “people are renting rooms at motels for $125 a week or $150 a week. So for $600 a month, they have no other bills. Everything is provided for them—heat, lights, rent, cable, internet.” In fact, in Clay County, one agency often helped people find hotel rooms and provided some funds as a last resort to prevent homelessness, an option that was not widely available to those in the less tourism-focused Union County (neither county has a homeless shelter). While this may be an affordable fix, these facilities do not provide stable, long-term solutions, nor the full array of amenities needed for routine family life (for example, full kitchen, adequate bedrooms). Other providers saw “a lot of people that are bouncing from couch to couch” in order to make ends meet. Of course these arrangements can be unstable at best, and unsafe at worst. “People are living in really bad, bad situations,” said one Union County provider.

Opportunities for Policy and Practice

Subsidies and publicly funded programs can play a part in alleviating the challenges of affordable rural housing, but addressing the issue of affordable housing in rural places will require a variety of approaches. For instance, at the local level, residents can encourage local zoning and planning boards to align town regulations with “inclusionary zoning” practices, such as requiring a certain percentage of housing units to meet affordability standards and offering incentives to developers for constructing affordable dwellings.7 Municipalities might also loosen or alter zoning restrictions to reduce lot size requirements and allow construction of structures other than traditional single-family dwellings, including duplexes, in-law apartments, backyard cottages, townhouses, or bungalow courts.8 These efforts can be further supported by legislation at the state level, as in New Hampshire, where a new law directs that every town with zoning regulations must allow accessory dwelling units (ADUs)—secondary dwellings on a single property, like in-law apartments and backyard cottages—in all zoning areas that allow single-family dwellings.9

Beyond creative zoning efforts, communities with a high share of seasonal rentals and other vacancies might encourage residents to find ways to repurpose dwellings on their own. For instance, in Union County housing units regularly become vacant when seniors move to assisted living facilities or die, but, as one provider explained, “The houses sit there, and it’s too bad they couldn’t rent them or something to these young families and give them something to get started with.” In Clay County, some experimental efforts have placed unhoused families in empty second properties with support from municipalities, providing a home for families who would otherwise be homeless and rental income to homeowners who would otherwise receive none. These homeowners work with the town and the renting families to create longer-term partnerships and possible rent-to-own arrangements for these families to improve stability over other kinds of seasonal rentals.

Of course, affordable housing is not just an issue in New England—rather, the issue affects rural (and urban) families across the nation. At the federal level, policies that fund and support upgrades to existing housing and expand access to existing subsidy programs could relieve some of the pressure on rural residents. However, as budgets from both the President and the House of Representatives’ Committee on Appropriations include significant cuts to HUD programs that support low income housing options,10 state and local policy makers and practitioners may have to continue efforts that extend beyond the federal safety net.

Data and Methods

The data used in this brief come from the qualitative Carsey Study on Community and Opportunity, conducted between 2011 and 2015 via three focus groups in Union County, two focus groups in Clay County, and twenty-nine interviews in each place, for a total of eighty-five participants. Data were transcribed and analyzed for emergent themes in NVivo 10. For full details on the study’s recruitment and analysis strategies, see the corresponding working paper.11 To protect the privacy of people in these small communities, we withhold details about people’s specific professions and personal lives in this brief. All of the themes discussed emerged from our analyses of these data; however, the qualitative data are supplemented in this brief with data from the American Community Survey and other sources to situate themes within the broader population context, noted where applicable.

Box 1. About the “Study of Community and Opportunity” Series

What is it like to live through the challenges confronted by vulnerable families? In our new “Study on Community and Opportunity” series, we use data from five years of conversations with residents, social service providers, and community members (eighty-five subjects in all) from two rural New England communities to provide depth to the issues that affect vulnerable families and to highlight the experiences of rural residents in their own words.

The broader study covers a wide range of themes around how people make ends meet in two different kinds of rural places. We call one community Union County, where a remote location and a seasonal, natural resource-based economy have generated a history of poverty, and the other Clay County, where a vibrant mix of natural amenities and a relatively central location attract wealthy retirees and tourists. From talking with people in these communities, we learned about their efforts to find and keep work, the use and adequacy of the social safety net, and some of the challenges and strengths of living in a rural community. In this brief, we explore the housing landscape for residents of these two places, grounding their stories in quantitative data where possible.

Endnotes

1. Sonali Mathur, “Are Renters and Homeowners in Rural Areas Cost-Burdened?” Housing Perspectives (Cambridge, MA: Harvard Joint Center for Housing Studies, 2016).

2. Carsey School of Public Policy analysis of American Community Survey 2015 one-year data.

3. Ibid.

4. County names have been changed to protect the identity of residents.

5. U.S. Department of Agriculture, Economic Research Service, “County Economic Types,” 2015 Edition, https://www.ers.usda.gov/data-products/county-typology-codes/description....

6. U.S. Department of Housing and Urban Development, “Housing Choice Vouchers Fact Sheet,” https://portal.hud.gov/hudportal/HUD?src=/topics/housing_choice_voucher_....

7. For instance, the state of Vermont has such an inclusionary zoning statute, which describes how municipal bylaws can require that certain percentages of proposed developments be “affordable,” and that incentives like reductions or waivers of certain fees, minimum lot sizes, or density requirements can be included in municipal zoning laws. See http://legislature.vermont.gov/statutes/fullchapter/24/117.

8. A variety of housing types that are neither mid-rise apartment buildings nor detached single-family homes have been described by architect Daniel Parolek as the “missing middle” of housing. While intended to meet growing housing needs in urban places, in many cases these types of structures can be equally applicable to rural living. For more detail on the missing middle, see www.missingmiddlehousing.com.

9. For more detail on accessory dwellings in New Hampshire, see “Planning for Accessory Dwelling,” New Hampshire Office of Energy and Planning, https://www.nh.gov/oep/planning/resources/accessory-dwellings.htm.

10. See “Summary of FY2018 Transportation-HUD Appropriations bill – Committee mark,” July 17, 2017, Committee on Appropriations – Democrats, https://democrats-appropriations.house.gov/news/press-releases/summary-o....

11. Marybeth J. Mattingly and Jessica A. Carson, “‘I Have a Job…But You Can’t Make a Living’: How County Economic Context Shapes Residents’ Livelihood Strategies,” working draft available from authors upon request.

Acknowledgements

The authors express deepest thanks to the participants in the Carsey Study on Community and Opportunity, who kindly shared their stories, and helped us understand their communities. The authors also thank Michael Ettlinger, Curt Grimm, Michele Dillon, and Amy Sterndale at the Carsey School of Public Policy for feedback on earlier drafts of this brief, and Laurel Lloyd and Bianca Nicolosi at the Carsey School for their assistance with layout.

This publication was made possible by Grant Number 90PD0275 from the Office of Planning, Research, and Evaluation, Administration for Children and Families, U.S. Department of Health and Human Services. Its contents are solely the responsibility of the authors and do not necessarily represent the official views of the Office of Planning, Research, and Evaluation, the Administration for Children and Families, or the U.S. Department of Health and Human Services.