download the brief

Key Findings

As in the United States as a whole, New Hampshire’s transportation infrastructure is in serious need of upgrading and maintenance. Addressing the problem will require substantial public investment, which will in turn require public awareness of infrastructure challenges and public understanding of the means to address them.

In connection with the Living Bridge project, an experimental “smart infrastructure” initiative in Portsmouth, New Hampshire (see Box 1), University of New Hampshire researchers added questions about transportation infrastructure to Granite State Poll surveys in February and July 2016 and again in May 2017. Each poll, conducted by the University of New Hampshire Survey Center, interviewed a random sample of approximately 500 New Hampshire residents via cellphone and landline, for a total of more than 1,500 interviews.1 This brief takes a first look at the results.

The Condition of New Hampshire Infrastructure

The “Infrastructure Report Card” compiled by the American Society of Civil Engineers (ASCE) grades infrastructure conditions in every state on a scale of

A to F:

-

A—Exceptional: fit for the future

-

B—Good: adequate for now

-

C—Mediocre: requires attention

-

D—Poor: at risk

-

F—Failing/critical: unfit for purpose

New Hampshire earned a grade of C– in the 2017 report (down from C in 2006) for its overall infrastructure as well as grades of C– for highways and roads (C in 2006), C– for rail systems, C– for bridges (C+ in 2006), and D+ for stormwater management.2 As of December 2016, 151 state-owned bridges were “red listed” by the New Hampshire Department of Transportation meaning that they were structurally deficient in some way.3 Red-listed bridges are expensive to maintain, require more frequent inspections, and may have weight restrictions limiting functional use. Problems are likely to increase in the future as funding for maintenance and repairs is spread thinner over old and newly constructed bridges.

As traffic across the state increases, a grade of C– for highways and roads reflects the fact that fewer than half of all roads in the state are in good condition, while 29 percent are poor or very poor. Only 8 percent of local, unnumbered roads are in good condition. The state’s rail systems are sufficient for passenger travel, but quickly falling behind industry standards for shipping cargo. Standards regarding stormwater runoff are becoming increasingly inadequate even as the state’s climate becomes more flood prone and more land is developed or paved with impermeable cover.4 Many stormwater structures are considered at risk of failure, and a 2010 study found that 83 percent of impairments to surface water in New Hampshire are caused by stormwater.5

Residents’ Perceptions of Infrastructure Conditions

To learn about New Hampshire residents’ subjective perceptions, our survey asked:

Which of the following three statements do you think is more accurate? The condition of basic highway, bridge, and transportation infrastructure in New Hampshire today is ...

-

Better than it was 10 or 20 years ago

-

About the same as it was 10 or 20 years ago

-

Worse than it was 10 or 20 years ago

-

(Don’t know/no answer)

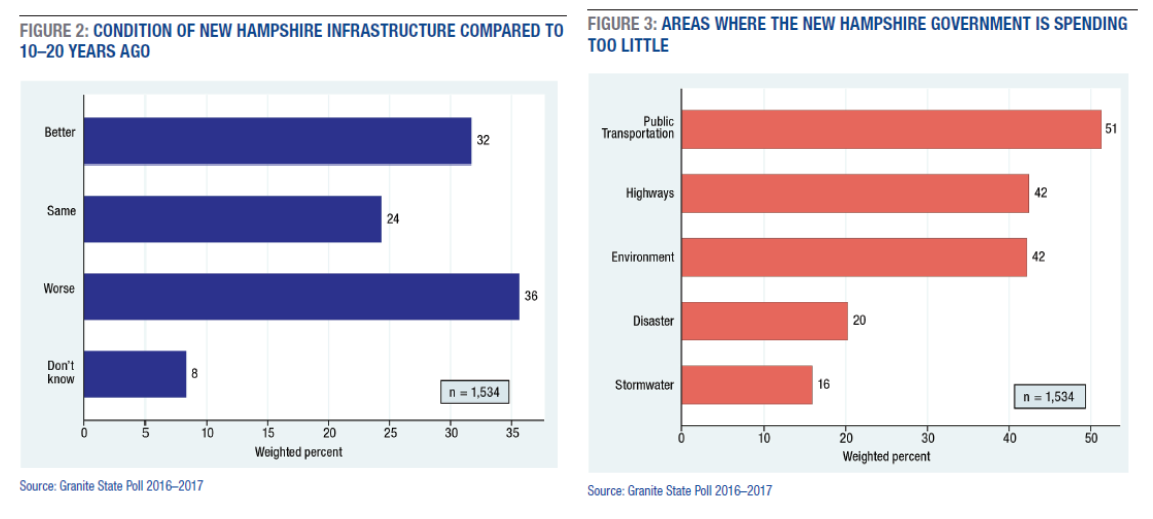

Figure 2 charts the responses.

Although the ASCE infrastructure study found evidence of worsening conditions, only 36 percent of respondents have noticed. Almost as many (32 percent) believe the condition of transportation infrastructure is better than 10 or 20 years ago, while many others (24 percent) think it is about the same. This range of responses underlines the low public awareness about the state of infrastructure in the absence of a crisis.

New Hampshire Infrastructure Priorities

Historically, New Hampshire has relied on turnpike tolls, gas taxes, and vehicle registration fees to support roads, highways, and bridges. The $250,000 allocated each year to maintain and repair state-owned railroads is currently adequate for maintenance, but it does not allow for improvements. As for stormwater, the built environment and infrastructure are insufficient for managing current levels, and they will be even less capable of dealing with future climate change. Though there are plans for improving the system, it is estimated it will take up to three decades to raise the money needed without increasing water-use fees.6 Will the public support this? Our survey asked:

There is much discussion about how much the New Hampshire state government should spend for different purposes. I’m going to name some of these purposes, and for each one I’d like you to tell me whether you think New Hampshire is spending too much money on it, too little money, or about the right amount. First ... are we spending too much, too little, or about the right amount on ….

-

Maintaining highways and bridges?

-

Protecting the environment?

-

Stormwater management?

-

Preparation for natural disasters?

-

Public transportation such as bus and train service?

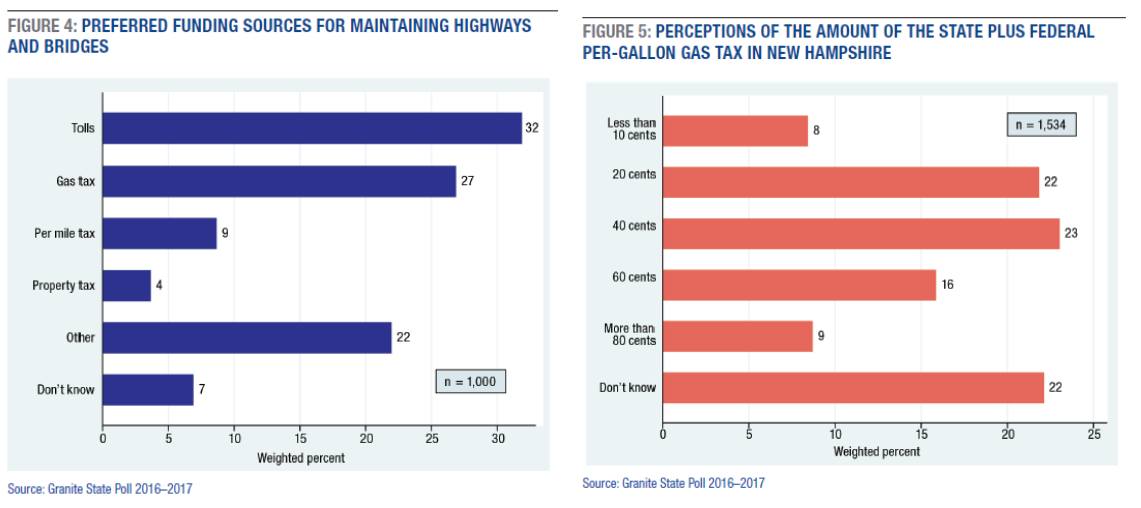

Figure 3 displays the percentages who said New Hampshire spends “too little” on each type of infrastructure. Support for increased spending is strongest regarding public transportation (51 percent), followed by highway and bridge maintenance and protection of the environment (42 percent each). Disaster preparation and stormwater management receive less support—only 20 percent and 16 percent, respectively, said the state is not spending enough—although sizable shares (23 and 33 percent) said they did not know enough to have an opinion in these areas. These high shares suggest that a lack of information, rather than opposition to spending, may be driving opinions about spending on stormwater management and disaster preparation.

Paying for Maintenance

Since the early 1900s, the primary state funding sources for highways and roads have been fuel taxes and tolls.7 In the decades following imposition of the first federal gas tax in 1959, the rate rose with inflation, but there have been no increases since 1993. Meanwhile, improvements in fuel efficiency have led to declines in the per-mile tax collected. A car getting 35 miles per gallon will contribute less in gas taxes than a car getting 23 miles per gallon, with equal miles traveled. Similar trends have affected New Hampshire’s gas tax, which was raised to 23.8 cents per gallon in 2015 after holding steady at 19.6 since 1999.8 Failing to adjust tax income to offset changes in technology or inflation creates a widening gap in funding. Moreover, some researchers believe that vehicle miles traveled have peaked,9 which if true would further limit the funds that can be collected.

In sum, the fuel tax that was intended to be a rough proxy for miles traveled—and therefore wear on infrastructure—no longer serves this purpose well. With this in mind, we asked respondents about other possible sources of funding:

What do you think should be the main source of funds needed to maintain New Hampshire highways and bridges?

-

Gasoline tax

-

Annual per-mile tax at vehicle registration

-

Highway tolls

-

Real estate tax

-

Or something else?

-

(Don’t know/no answer)

There is no general agreement on how infrastructure should be paid for. Figure 4 shows that highway tolls are the most popular method (32 percent), followed by the gasoline tax (27 percent), but these numbers reflect current well-known practices. Per-mile fees are a less familiar concept, so low support for them is perhaps not surprising.

The choice by 22 percent of “something else” besides the realistic choices offered may signal a belief that someone else should pay for infrastructure, or perhaps indicates that residents have not previously considered where funding for roads comes from. The results in Figure 4 underline a need for informed public discussion about the options available to meet infrastructure needs.

Proponents of per-mile fees argue that they offer distinct benefits over gas taxes and would allow highway users to pay directly for road service in the same way that they pay for utilities such as electricity and water. Moreover, research has shown that a per-mile tax, compared with the current system of tolls and gas taxes, would be a more accurate reflection of road usage.10 Without details and public understanding, however, people are less likely to consider per-mile fees as a viable option.

How Much Is the Gas Tax?

What do state residents know about gas taxes? The current tax in New Hampshire is 42.4 cents per gallon for regular unleaded, reflecting a state tax of 23.8 cents per gallon and a federal tax of 18.4 cents. Accurate knowledge on the part of the public could be a key factor as policy choices are being considered.

Using round numbers, the survey assessed people’s knowledge with the following:

Next, I have a couple of questions about gasoline taxes in New Hampshire. Approximately how much do you think the combined state and federal tax is, on a gallon of gas in New Hampshire?

-

Less than 10 cents per gallon

-

Around 20 cents per gallon

-

Around 40 cents per gallon

-

Around 60 cents per gallon

-

More than 80 cents per gallon

-

(Don’t know/no answer)

Fewer than one quarter of respondents knew or correctly guessed “around 40 cents per gallon” (Figure 5). Thirty percent thought it was less, and 25 percent thought more; the remainder admitted they had no idea.

Should the Gas Tax Increase?

Because the gas tax has not increased federally since 1993 or in New Hampshire since 2015—after a 15-year stasis—increasing the tax today could run into significant opposition from voters. To explore how much (if any) increase might be acceptable, we asked:

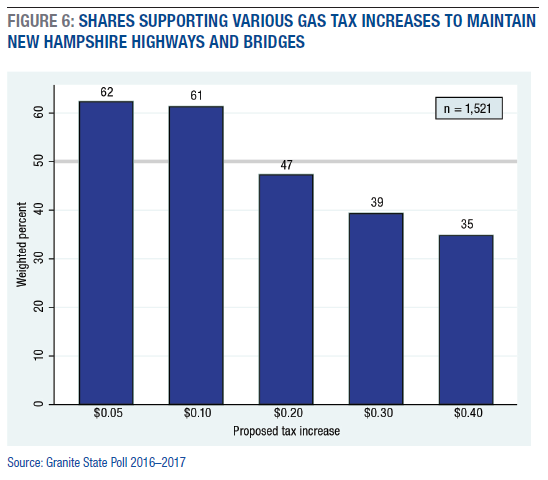

Would you support increasing the gas tax by an additional __ cents per gallon, if the funds are needed to maintain New Hampshire highways and bridges?The amount of gas tax specified in this question was varied at random across different interviews. About one-fifth (roughly 300) of the respondents were asked if they would support 5 cents per gallon, another 300 were asked about 10 cents per gallon, and so forth through 20, 30, or 40 cents per gallon. Figure 6 summarizes their responses. Sixty-two percent of those asked about a 5 cent per gallon increase said they would support it, as did 61 percent of those asked about a 10 cent per gallon increase. Among those asked about greater increases, support dropped off from 47 percent for a 20 cent increase to 35 percent for a 40 cent increase. A key takeaway from this analysis is that majority support exists for increases of 10 cents or less, but support drops off at levels of 20 cents or more. The 12 cent increase that was proposed but not adopted in 2014 seems to fall in an acceptable range.

The modest size of the increases supported highlights a limitation of using fuel taxes to maintain highways and bridges. An additional limitation is that, while any increase would generate additional revenue, the rising number of fuel-efficient vehicles on the road means that gas tax increases by themselves may not offer a long-term solution for road maintenance.

Who Would Support a Gas Tax Increase?

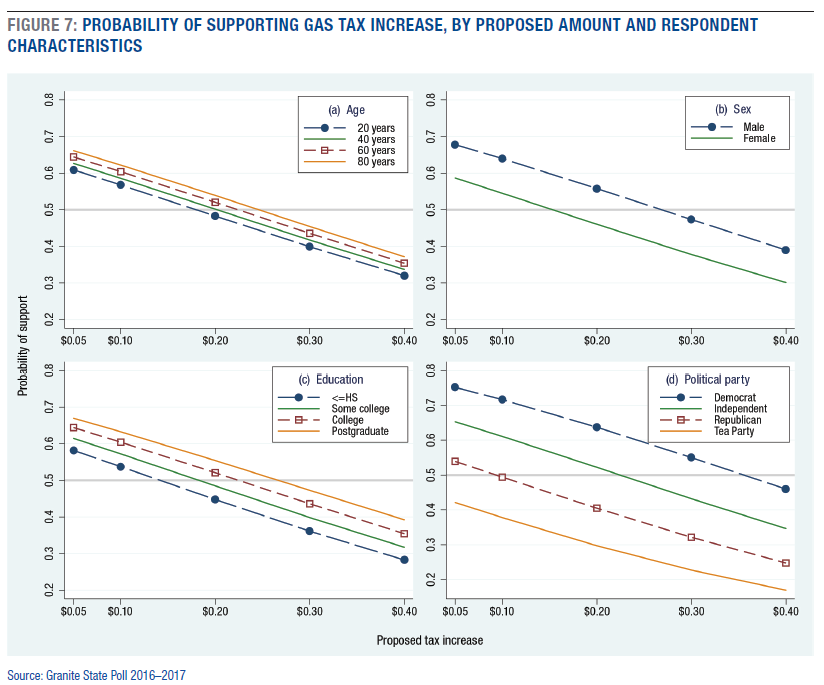

An important policy question is who would support a given level of tax increase. Figure 7 illustrates results from a statistical analysis. The probability of supporting a tax increase is graphed against the amount of that increase, but separately for respondents of different ages, gender, education, and political parties.11

Figure 7a shows that age has only a slight impact on support for a gas tax; majorities within each age group say they would support an increase of 5 or 10 cents. Figure 7b shows that a majority of men, but not women, would favor an increase up to 20 cents per gallon. Figure 7c shows that a majority of those with college or postgraduate degrees also would support up to a 20 cent increase.12

A wider gap appears in Figure 7d, which depicts the effects of political identity. Independents are more likely to support gas tax increases up to 20 cents, and Democrats up to 30 cents, if the funds are needed to maintain New Hampshire highways and bridges. A majority of Republicans would support increases of only 5 cents or less. Most Tea Party supporters do not approve of tax increases of any amount.

Other analyses (not shown) reveal correlations between political outlook and perceptions about the physical condition of highways and bridges. For example, 37 percent of Republicans and Tea Party supporters but just 29 percent of Democrats and independents say that state highway, bridge, and transportation structure is better now than 10 or 20 years ago.13 A counterfactual perception that infrastructure conditions have improved and a belief that no tax increases are needed thus appear to be ideologically connected. Education about infrastructure needs can focus on objective criteria and risks, but also must address ideological opposition to taxation.

Conclusion

Although most New Hampshire residents depend on the state’s transportation infrastructure, only a minority have noticed that it is challenged by aging structures, increasing demand, a changing vehicle mix, and rising stormwater threats. Money coming in is insufficient to support current infrastructure or to update and keep ahead of anticipated changes, and the poorly maintained roads are costing drivers significant amounts in additional vehicle maintenance. This situation will worsen with flat funding, because gas taxes and tolls only partly reflect miles traveled on roads.

An increase in the gas tax could provide immediate additional funding for infrastructure, but increasingly fuel-efficient vehicles reduce the efficacy of gas taxes as a primary way to pay for infrastructure. Our surveys find that few state residents know what the current gas tax is, but in principle a majority would support a modest increase, making it a plausible first step. Other possible sources, notably a per-mile tax, have less support partly because they are less familiar. There should be room here for greater public discussion that raises awareness of the problems and the need for solutions—even some solutions not tried in the state before.

Endnotes

1. The three Granite State Poll surveys with these questions had an average response rate of 17 percent, calculated by definition 4 from American Association for Public Opinion Research, Standard Definitions: Final Disposition of Case Codes and Outcome Rates for Surveys, 4th ed. (Lenexa, KS: American Association for Public Opinion Research, 2006).

2. NH Report Card Committee, “Report Card for New Hampshire’s Infrastructure” (American Society of Civil Engineers, 2017), available at infrastructurereportcard.org.

3. New Hampshire Department of Transportation, “2016 State Red List” (2017), https://www.nh.gov/dot/org/projectdevelopment/bridgedesign/documents/201....

4. L.C. Hamilton, C.P. Wake, J. Hartter, T.G. Safford & A. Puchlopek, “Flood realities, perceptions, and the depth of divisions on climate,” Sociology 50 (2016): 913–933, doi: 10.1177/0038038516648547.

5. New Hampshire Department of Environmental Services (NHDES), “Section 305(b) and 303(d) Surface Water Quality Report,” http://www.des.nh.gov/organization/divisions/water/wmb/swqa/2008.

6. TRIP, “Key Facts about New Hampshire’s Surface Transportation System and Federal Funding,” August 2016, www.tripnet.org/docs/Fact_Sheet_NH.pdf.

7. New Hampshire Department of Transportation, “Highway Maintenance,” https://www.nh.gov/dot/org/operations/highwaymaintenance/.

8. U.S. Department of Transportation, Federal Highway Administration, “State Motor-Fuel Tax Rates, 1991–2005,” https://www.fhwa.dot.gov/policy/ohim/hs05/pdf/mf205.pdf.

9. Robert W. Poole Jr. and Adrian Moore, “Ten Reasons Why Per-Mile Tolling Is a Better Highway User Fee Than Fuel Taxes,” Policy Brief 114 (Washington, DC: Reason Foundation, 2014).

10. Poole and Moore, 2014.

11. Figure 7 shows four adjusted margins plots, all derived from one weighted logit regression model that predicts support for a tax increase based on respondent age, gender, education, political party, education×party interaction, and the amount of increase (5 to 40 cents) specified in that person’s survey interview.

12. Age effects are not significant, but gender, education, and party effects are—as determined by t statistics in the logit regression analysis.

13. This difference is statistically significant, as are others involving party or ideological comparisons of the infrastructure responses shown in Figure 2.

Acknowledgements

This research was carried out under the Living Bridge project, supported by grants from the National Science Foundation (IIP-1230460 and 1430260). Information about stormwater was provided by the University of New Hampshire Stormwater Center. Any opinions, findings, and conclusions or recommendations expressed in this material are those of the authors and do not necessarily reflect the views of the National Science Foundation.