Project Readiness Questions

- What structures for community solar are currently allowable in your state?

- What are the key regulatory and market considerations for a specific location that will influence community solar project success?

- How does electricity pricing in your specific market impact project viability?

- What specific state and local laws facilitate or hinder community solar?

Background

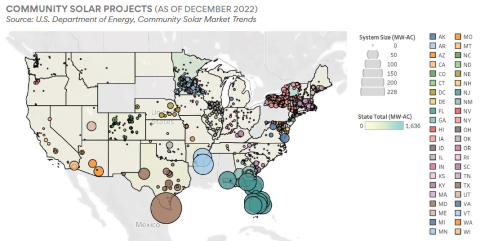

Electric generation policies vary greatly by state, which has major impacts on how community solar can be developed. The U.S. Department of Energy defines Community Solar as any solar project or purchasing program, within a geographic area, in which the benefits flow to multiple customers such as individuals, businesses, nonprofits, and other groups. According to the U.S. Department of Energy, at least one community solar project exists in 40 states, including Washington D.C. Twenty-two (22) states and the District of Columbia have state-level policies that support community solar deployment. These policies are a combination of mandated levels of community solar deployment, incentives for deployment, policies that make deployment easier, or some combination of these.

While community solar projects have developed rapidly, nearly three-quarters of the market is currently concentrated in four states: Minnesota, New York, Massachusetts, and Florida. Developing community solar projects requires an understanding of the complex regulatory and market context of each state.

Each state has its own regulatory environment that governs the development of community solar projects. It’s important to understand the relevant state laws and regulations, including utility commission rules and interconnection standards. For example, some states may only allow community solar projects within specific utility territories, while others allow community solar projects to be located anywhere throughout the state. Understanding these rules and regulations will help you to determine the feasibility of community solar projects in specific states.

The market context of a state is equally important to consider when developing community solar projects. Factors such as electricity prices, the availability of incentives and subsidies (i.e. grants and renewable energy credits), and the level of demand for renewable energy can all impact the feasibility of a community solar project. In some states the cost of electricity is high, which can make community solar projects more economically viable. Similarly, in states with strong legislative demand for renewable energy, community solar projects may have a larger potential customer base.

Policies such as net-metering, virtual net-metering, streamlined interconnection standards across all solar, and strong incentives and subsidies for community solar development can promote the development of community solar. In community-solar-friendly states, you will find one or more of the following kinds of supports available to expand community solar markets and support community solar developers:

• Community Solar Enabling Legislation. This specific state-level legislation either allows third-parties to own and operate community solar or mandates that utilities partner with community-based organizations to pursue community solar.

• Virtual net metering. These policies allow community solar customers to receive credit on their electric bills for the power produced by a community solar project.

• Streamlined interconnection policies. These policies make it easier for community solar projects to connect to the grid.

• Interconnection standards. These govern the technical requirements for connecting a solar project to the grid. Streamlined and standardized interconnection standards can promote the development of community solar by reducing the administrative burden and cost of connecting a solar project to the grid.

• Renewable Portfolio Standards (RPS). RPS require or encourage utilities to produce a certain amount of their power from renewable sources. These standards, in turn, can allow community solar developers to earn money from selling Renewable Energy Credits (RECs). The RECs prices are determined at the state level.

• Community Choice Aggregation Programs. Community Choice Aggregators (CCAs) aggregate the buying power of individual customers within a defined jurisdiction to negotiate with electricity supply companies regarding price, term, and sourcing on behalf of residents and small businesses to create a new local default supply option. CCA programs can purchase power from community solar facilities.

• Incentives and subsidies. Strong and consistent state or local incentives and subsidies can promote the development of community solar by reducing the upfront costs and making it more financially feasible.

• Regulatory process. Streamlined and predictable regulatory processes reduce the administrative burden and cost of obtaining permits and approvals.

Community Solar Ownership Options

Community solar ownership options are largely determined by state legislation. As such, when considering a community solar ownership structure, it is critical that you first understand what is allowable in your state. Community solar can be developed in all 50 states, the District of Columbia, and territories through one of the five pathways listed below:

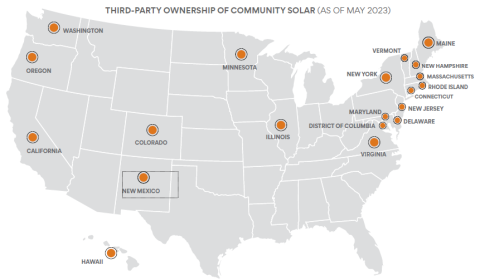

The biggest regulatory concern shaping community solar development across the country is whether states allow community solar to be developed by an entity that is not regulated by the state as a formal utility provider or whether community solar must be developed in partnership with a regulated utility. Third-party ownership is defined as allowing investors to form a new company to finance, own, and operate community solar without any ownership participation from a regulated utility.

Because third-party ownership enables community groups to be engaged in structuring the capital sources and expenses of developing a community solar project, the structure allows for the most flexibility in providing different and deeper benefits to LMI communities. 19 states, plus the District of Columbia, allow third-party ownership of community solar, including the following (as of May 2023).

In a cooperative community solar structure, a group of customers collectively own and operate a solar project. This structure can provide customers with the most control during the development process, yet cooperative ownership requires significant organization and coordination among the members. This structure is only allowable in the 19 states and D.C. that allow third-party ownership of community solar without participation by regulated utilities, unless specifically requested and allowed in partnership with a Rural Electric Cooperative or Municipal Utility.

For above references, the following resource lists the 22 states plus the District of Columbia that have enabling legislation for community solar.

Regulated investor-owned utilities are those granted the exclusive right by each state to sell power within a certain territory. State Public Utility Commissions set the rules for regulated utilities, and these utilities are entrusted with ensuring reliable and affordable electric power to all residents in a given territory. Meeting these incredibly rigorous standards is very expensive and time consuming, requiring the resources of massive companies to achieve the required standards. Unfortunately, the time and expense necessary to meet these standards often serve as insurmountable barriers to entry for potential solar developers trying to develop community solar projects within a given territory without the participation and ownership from the local regulated utility.

Those seeking to develop community solar in the 31 states without specific third-party ownership enabling legislation must partner with their local regulated utility. The U.S Environmental Protection Agency defines this structure as the “Utility-sponsored model,” whereby a solar developer or community- based organization partners with a regulated utility to develop community solar. The regulated utility owns, operates, and controls the community solar project with input from the developer or community- based organization.

The following states do not allow third-party ownership of community solar but have established mandates for their regulated utilities to participate with community-based organizations in community solar. As of May 2023, the following are states with investor-owned utility-owned community solar:

• Nevada

• North Carolina

• South Carolina

There are a few other notable states where solar development is not mandated but the utilities have volunteered to develop community solar, including the State of Florida.

(i.e., Community Choice Aggregation or CCAs)

In those states where third-party ownership of community solar is not allowed and regulated utility- ownership is not mandated, it may be possible to partner with a local government to deliver community solar benefits. Municipal Ownership, also known as Community Choice Aggregation, allows local governments to procure power on behalf of their residents, businesses, and municipal accounts from an alternative energy supplier while still receiving transmission and distribution service from their existing regulated utility provider. CCAs are attractive for communities that want more local control over their electricity sources, more green power than is offered by the default utility, and/or lower electricity prices.

In 2022, the EPA estimates that about 5.7 million customers procured about 16 billion kWh of electricity through CCAs. Learn more on the status of states’ efforts to enact CCA-enabling legislation.

By aggregating demand, communities gain leverage to negotiate better rates with competitive suppliers and choose greener power sources. CCAs are currently authorized in the following states:

- California

- Illinois

- Maryland

- Massachusetts

- New Hampshire

- New Jersey

- New York

- Ohio

- Rhode Island

- Virginia

Municipal utilities are publicly-owned electric power entities operated by local governments. According to data published by the American Public Power Association, they make up a significant portion of the national electric utility industry. Publicly owned utilities—which may include municipal utilities, water and power districts, and other public entities—make up roughly 60% of the nation’s utilities (more than 2,000), serve 15% of all customers (21.4 million), and deliver 15% of annual end-use electricity sales (574 terawatt- hours, TWh). The size and scope of municipal utilities vary widely as they are naturally constrained by the boundaries of their underlying jurisdictions. The majority of municipal utilities are small, serving fewer than 3,000 residents, but some larger cities—Los Angeles, Seattle, Austin, Orlando, and Sacramento, for example—operate much larger municipal utility districts.

Because municipal utility customers are also voters who elect the officials governing the utility, these arrangements can foster outcomes that are more directly responsive to customer needs which can include support for community solar. As such, some of the first community solar projects in the nation were initiated by municipal utilities. Sacramento Municipal Utility District (SMUD) in California, for example, launched its SolarShares program in 2008 with a 1-MW installation. Today they operate 11 community solar projects. For more information on how municipal utilities can engage on LMI community solar development, please refer to the Municipal Utility Community Solar Workbook, authored by the American Public Power Association, the National Renewable Energy Laboratory, and the U.S. Department of Energy.

Partnering with rural electric cooperatives is another pathway to developing community solar. Rural electric cooperatives (also called “electric co-ops”) are non-profit electric utilities. Unlike investor-owned utilities, rural coops are owned by member-owners, i.e., the customers for which they provide electricity. Rural co-ops were created in the 1930s to bring electricity to areas of rural America that investor- owned utilities refused to serve due to high costs. Today, electric cooperatives provide electricity to 12% of Americans and own 42% of the country’s electric distribution lines.

Because rural electric cooperatives are owned by their customers, they can be responsive to customers who advocate for community solar in their communities. Electric co-ops are not regulated by state public utilities commissions, which presents the opportunity for some to be more nimble and innovative. These coops are able to ensure that rural populations, which are often vulnerable to higher energy burdens and lower financial stability, are able to have equitable access to community solar opportunities.

Rural electric cooperatives exist in almost every state, especially in those states where third-party ownership or utility-owned community solar is not available. Partnering with electric co-ops makes community solar possible in all 50 states. For more information on how rural electric cooperatives are making progress on community solar, you can visit NRECA Electric Cooperatives & Solar.

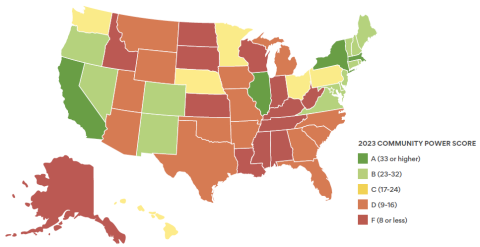

ILSR 2023 Community Power Scorecard

The Institute for Local Self Reliance (ILSR) 2023 Community Power Scorecard is a report that ranks U.S. states based on their policies and programs related to community solar, energy efficiency, and energy storage. The scorecard, which was first released in 2021, is updated every two years by the nonprofit organizations Vote Solar and the Interstate Renewable Energy Council (IREC). The scorecard compiles data from the American Council for an Energy-Efficient Economy, DSIRE, the National Renewable Energy Laboratory, PACENation, SolarReviews, and Vote Solar, as well as the data ILSR regularly track on community solar, community choice aggregation, and state legislative changes in general. Readers should keep in mind that Community Scorecard focuses on community-solar-friendly policies, which are a major indicator of the ability to install community solar but not the only factor. The orange and red colors do not mean that Community Solar cannot be developed in those states, but rather that there are presently more barriers to development. For example, Minnesota, which is yellow, is one of the states with the most community solar deployed. Florida is red because it does not allow virtual net-metering and is very restrictive to community solar. Yet, Florida Power and Light, the investor-owned utility, has voluntarily developed over 1 GW of community solar.

Action Items

Watch Market Environments for Community Solar

Determine the solar capacity installed in your state:

Solar Energy Industries Association (SEIA) Solar State by State webpage defines characteristics of the solar markets in each state.

Determine electricity prices in the state and utility area:

The U.S. Energy Information Administration (EIA) state electricity profiles provide the average retail electricity price in terms of cents per kilowatt-hour.

Compare grid electricity prices to the cost of solar:

The more expensive grid electricity is, the easier it is to make a solar energy project pencil out.

Watch Regulatory Environments for Solar

- Are policies supporting solar energy in place in your state?

The Institute for Local Self-Reliance tracks and scores states based on their energy policies and how these policies help or hinder local clean energy action on the 2023 Community Power Scorecard.

- Net Metering and Community Solar: Powering Your Local Community

Net metering allows people who own solar panels to sell any excess electricity they produce back to the grid, providing a significant financial incentive for individuals and businesses to invest in solar energy. Most solar projects, especially community solar initiatives, have much more favorable economics if net metering is allowed.

However, the timing mismatch between solar power generation and peak energy use creates a challenge for community solar developers. It is becoming more common for solar projects to include batteries and provide internal storage of power, but battery technology is expensive and still improving. Also, innovative solutions like virtual net metering are emerging, allowing subscribers to receive bill credits for their share of the electricity generated by a community solar project, even if it is located off-site. This opens up the benefits of solar energy to renters, homeowners with unsuitable roofs, and others who cannot install their own panels.

As such, net metering is often the single most important mechanism to have in place to create a friendly community solar regulatory environment. Look for a check mark under “customer-friendly net energy metering” in the 2023 Community Power Scorecard.

- Does your state have straightforward interconnection rules?

Interconnection is connecting a solar array to the power grid. Look for a checkmark on the community power map “ensures simplified interconnection rules to encourage distributed renewables.”

- Does your utility have requirements to purchase renewable energy?

Under a Renewable Portfolio Standard (RPS – sometimes called a Renewable Energy Standard), state regulations require utilities to purchase a target amount of electricity from renewable sources, and may include a solar-specific mandate. An RPS requirement also facilitates demand for incentives to fuel the private renewable development market. Look for a check mark under “requires utility renewable energy procurement.”

- How is the electricity market regulated in your State? What utilities serve your State?

In all states, Public Utilities Commissions (PUCs) regulate the rates and services of investor- owned electric utilities. On most PUC websites there is detailed information about which regulated electric utilities are operating in a state and what rates are charged for electricity. You can also find detailed policies about Renewable Portfolio Standards, net metering, and other issues impacting solar development on the community power map.

Watch Community Solar Incentives

- Learn the different types of community solar incentives and how they work. Upfront Incentives are essentially grants that serve to reduce the initial costs of developing community solar and lower the investment amount that must be paid back by a project, leaving funds available to provide more LMI benefits. Production-basedincentives are funds provided based on energy produced during system operation, usually for a set number of years. Tax-based incentives are benefits that come in the form of tax savings to the solar owners. They can be utilized by the solar owner and some can even be sold. They provide an additional source of funds to solar owners, which leaves more funds available for LMI benefits.

- When considering financing in Chapter 6, be thoughtful about any expiration dates for incentive programs or pilots and be sure to let your funders know the milestones that have to be met to secure the incentive.

Use our project feasibility checklist and the Regulatory and Market Environment Guide to summarize the information you found in above action items.

Community Solar Participation In States Without Enabling Legislation

Developing community solar projects in states without enabling legislation may require a combination of efforts including creative financing options, leveraging existing infrastructure, collaboration with utilities, and education and outreach efforts. By employing these strategies, project developers can overcome regulatory barriers and successfully develop community solar projects even in states without enabling legislation.

- Focus on Education and Outreach: In states without enabling legislation, there may be a lack of awareness or understanding of the benefits of community solar. To overcome this, project developers can focus on educating the community about community solar to build strong support for the benefits of solar. This can include hosting community meetings, engaging with local media outlets, working with groups to build awareness and support for community solar and partnering with organizations that serve low-income communities, such as community action agencies.

- Seek Creative Financing Options: In states without enabling legislation, financing can be a major barrier to developing community solar projects. To overcome this, project developers may need to seek out creative financing options, such as philanthropy, community ownership models, crowdfunding, community bonds, or power purchase agreements (PPAs). These financing options can help to reduce the upfront costs of developing a community solar project and make it more financially feasible.

- Leverage Existing Infrastructure: In states without enabling legislation, it may be difficult to find suitable land for community solar projects. To overcome this challenge, project developers may need to leverage existing infrastructure, such as rooftops or parking lots, for the installation of solar panels. This can help to reduce land costs and make the project more cost effective.

Eyes on Equity

State policy and regulations affect the uptake of Community Solar in LMI communities. Community solar is a powerful tool to provide solar benefits to those without easy access to the property or upfront capital needed to install a solar system.

In many cases, states with equitable electricity decarbonization policies mandate delivering targeted benefits to historically disadvantaged communities.

- Programs that target LMI communities need to have deeper incentives to provide long-term financial stability and community wealth going beyond short-term solutions and providing deeper incentives to create lasting change. This could include offering financial incentives, such as tax credits, grants, or low-interest loans, to encourage investment in affordable housing, small business development, and job training programs.

- Regulations pertaining to net energy metering or NEM, virtual net metering (VNEM), and other electricity rate design measures that compensate residential solar customers for the energy and other benefits they provide to the grid are essential for expanding access to low-income communities. By compensating residential solar customers for the excess energy they produce, NEM and VNEM policies provide a financial incentive for homeowners to invest in solar panels and other renewable energy technologies.

- Where possible, programs should include local hiring provisions for installers to create positive workforce outcomes in addition to energy access benefits. Local hiring provisions require that a certain percentage of the workforce hired for the installation of renewable energy systems come from the surrounding community.

Tool: The Low Income Solar Policy Guide provides a road map to successful policies and programs that are creating access to solar technology and jobs nationwide.

ADDITIONAL RESOURCES

• Environmental Law & Policy Center: Community- Owned Community Solar

• The Database of State Incentives for Renewables and Efficiency: a comprehensive source on renewable energy policies and incentives.

• Coalition for Community Solar Access: Learn more about the impact of community solar and download critical resources from CCSA and other organizations to bring community solar to your state.

• IREC: Shared Renewable Energy for Low- to Moderate-Income Consumers: Policy Guidelines and Model Provisions: These guidelines support the adoption and implementation of shared renewables programs that provide tangible benefits to LMI individuals and households.

• National Renewable Energy Laboratory Low- and Moderate-Income Solar Policy Basics: A resource to learn about low- and moderate- income solar policy basics in state, local, and tribal governments.